SaaS 0-$30M: 5 metrics that can be turned into competitive advantage

From zero to $30M ARR - what SaaS businesses should benchmark themselves to.

Scaling a SaaS business is no small feat—it demands data-driven strategies and a laser focus on the right performance metrics. The ChartMogul SaaS Growth Report 2023 offers invaluable benchmarks and insights for founders and operators looking to grow from zero to $30M ARR and beyond. Let’s explore five key metrics that can guide the journey of an early stage SaaS company.

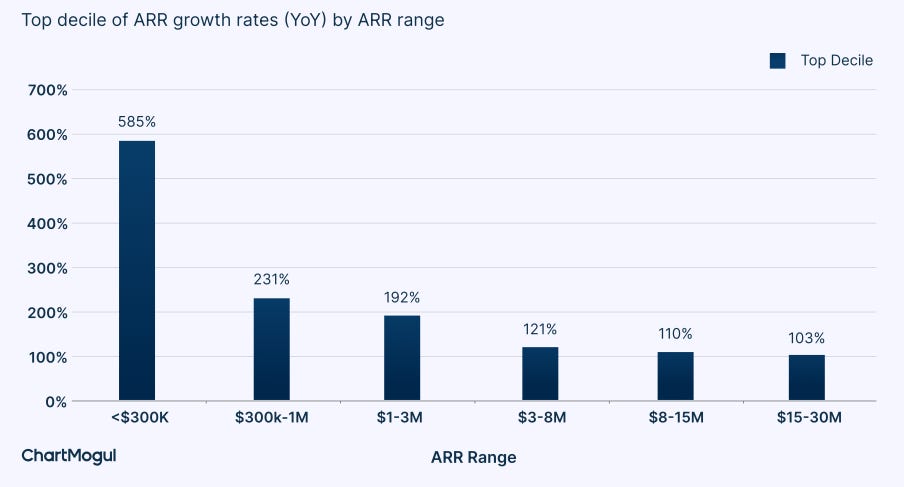

1. Growth benchmarks: what’s good growth?

Best-in-class companies grow ~150% annually, average companies grow ~65%, and those in the $1-3M ARR range achieve a 192% yearly growth.

Time to revenue is another benchmark:

Top-tier SaaS businesses hit $1M ARR in just 9 months.

The median startup takes almost 3 years to reach the same milestone.

Achieving $10M ARR takes the best performers under 3 years, while the median company requires over 5 years.

Actionable tip: Rapid iteration and relentless focus on product-market fit are a strong predictor of your future revenue growth.

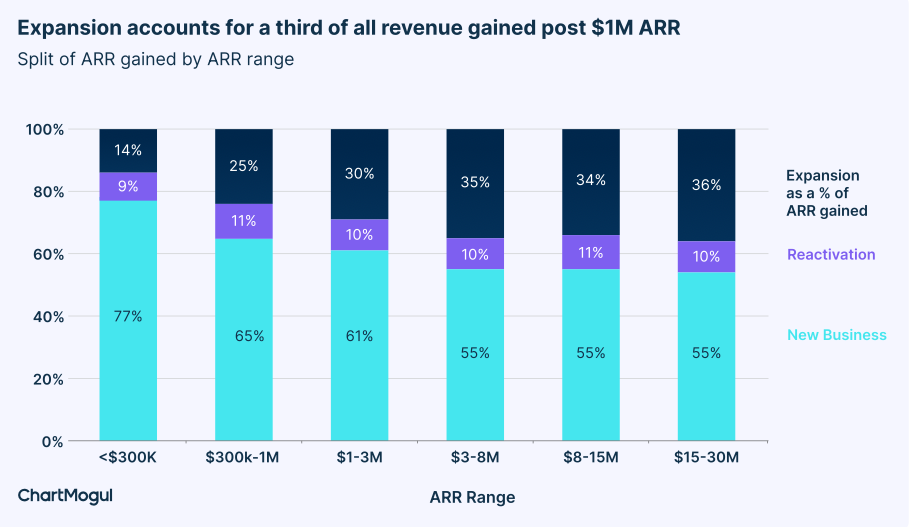

2. New Business vs. Expansion: where is growth coming from?

As SaaS businesses mature, their growth dynamics shift. Early-stage startups rely heavily on acquiring new customers, but mid-sized companies ($5-30M ARR) see up to 36% of revenue come from expansion through upselling and cross-selling.

The breakdown of growth drivers:

New business contributed 61% of revenue growth in 2020 but has since dropped to 53%.

Expansion now plays a larger role, particularly for B2B companies with higher average revenue per account (ARPA).

Actionable Tip: Build a product roadmap that supports expansion opportunities. Empower your sales and customer success teams to identify upsell and cross-sell opportunities.

3. Retention and Reactivation: the hidden drivers of growth

Retention is the backbone of sustainable SaaS growth. Companies with net retention rates above 100% grow 54% annually, compared to just 12% for those with lower retention.

Top quartile companies reactivate ~25% of lost customers. Reactivating churned users is cost-effective—they already know your product and require less convincing.

Actionable tip: invest in retention-focused strategies early. Leverage data to identify churn risks, and run targeted reactivation campaigns for former customers.

4. Billing frequency: how it changes as you scale

Billing frequency evolves as SaaS businesses grow:

Early-stage companies (<$300K ARR) see 28% of revenue from annual plans.

Mature companies ($15-30M ARR) derive 41% of their ARR from annual plans.

For B2C SaaS businesses, annual plans are especially popular. They help lock in customers for longer periods and optimize cash flow, particularly in industries with high churn rates.

Actionable tip: offer flexible monthly plans for smaller customers and incentivize larger accounts to commit to annual contracts. Use pricing and billing cycles as levers to appeal to different customer segments and business goals.

5. Reacting to seasonality and churn

SaaS businesses experience mild seasonality, with Q1 being the strongest quarter and Q4 the weakest. March typically sees the highest growth, while July and December lag due to holidays. Additionally, early-stage B2C companies may face high churn as viral customer acquisition leads to short-term signups. Obviously, seasonality is typical of each business/segment, so take this with a grain of salt.

Actionable tip: align your sales and marketing strategies with seasonal patterns.

Conclusion

SaaS growth is shaped by a range of factors, from the speed at which companies hit revenue milestones to the balance between new customer acquisition and expansion revenue. Reactivation, in addition to retention, emerges as critical driver of sustainable growth, while billing frequency evolves as businesses scale. Seasonality and churn patterns add further nuance to the growth journey, underscoring the importance of timing and strategy. Together, these five metrics offer a comprehensive view of how SaaS businesses navigate the path to $30M ARR (and beyond).