The Federal Reserve Payments Study: 7 insights on Cards and Alternative Payments

A Nov-2024 report from the Federal Reserve aggregates and analyzes noncash payment volumes in 2021 and 2022. Here's the summary.

Key Takeaways

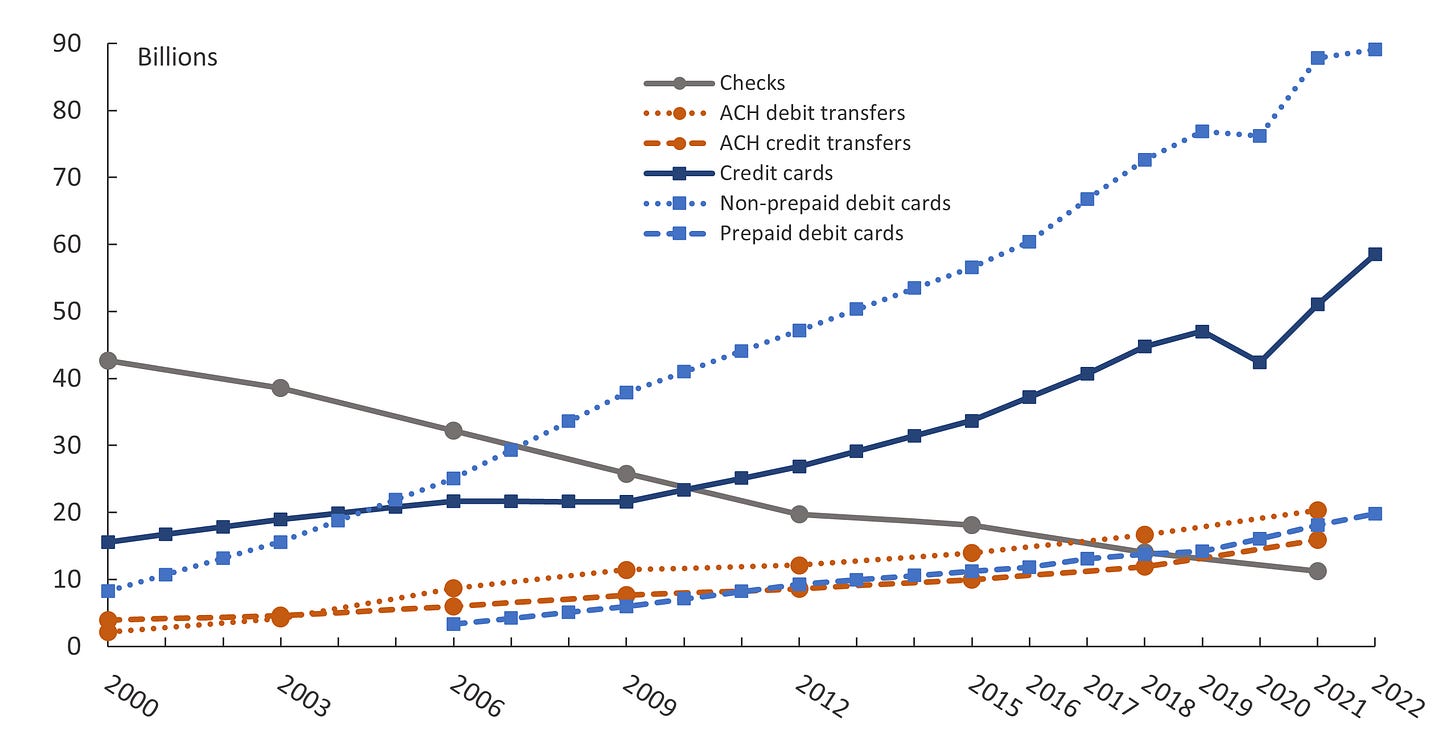

📉 Checks are becoming infrequent: The decline in check usage is accelerating, driven by digital alternatives that offer greater convenience and lower costs.

💳 Cards are king: Debit and credit card payments continue to rise, fueled by consumer preference and expanding merchant acceptance.

🔄 ACH transfers boom: ACH payments are thriving, thanks to their flexibility and adoption in payroll, vendor payments, and subscriptions.

⚡ Instant payments are here: FedNow and other real-time payment solutions are reshaping expectations for immediate, 24/7 transaction capabilities.

A Nov-2024 report from the Federal Reserve aggregates and analyzes noncash payment volumes in 2021 and 2022. Here's the summary.

📉 What’s declining: the fall of checks

For decades, checks were a staple of the American payments system, but their usage has been steadily shrinking. In 2015, Americans wrote 18.1 billion checks; by 2021, that number plummeted to 11.2 billion.

What’s driving this decline?

The Rise of digital banking: Why pull out a checkbook when you can pay bills through your bank’s app? Mobile and online banking have fundamentally changed consumer behavior, making checks seem archaic.

Business efficiency: Companies are moving away from checks due to processing costs and the risk of fraud. ACH transfers, wire payments, and digital wallets offer faster, cheaper, and more secure options.

Security concerns: Checks are vulnerable to theft and fraud, while digital payments come with encryption and better fraud detection systems.

The bottom line: Checks are becoming a relic of the past as consumers and businesses embrace digital-first solutions that are faster, safer, and more cost-effective.

💳 What’s growing: The dominance of card payments

If checks are fading, cards are taking the spotlight. Credit and debit card transactions hit 157 billion in 2021, up from just over 100 billion in 2015.

What’s driving this growth?

Consumer preference for convenience: Cards offer unparalleled ease of use, whether online or in-store. Tap-to-pay, contactless payments, and digital wallets have made transactions faster and more seamless.

Merchant expansion: Even small businesses have embraced card payments, helped by the rise of point-of-sale solutions like Square and Shopify.

Rewards and incentives: Cashback, points, and travel rewards continue to make credit cards an attractive option for consumers seeking value from their purchases.

Why it matters: The steady rise in card payments signals an ongoing shift towards frictionless, customer-centric payment experiences. This trend is likely to continue as contactless payments and digital wallets become even more prevalent.

🔄 What’s growing: ACH transfers

ACH (Automated Clearing House) payments have quietly become a backbone of the U.S. financial system, with both credit and debit transfers growing year over year. In 2021, ACH credit transfers reached nearly 16 billion transactions.

What’s driving this growth?

Business adoption: ACH is the go-to choice for payroll, vendor payments, and other large disbursements. It’s efficient, reliable, and cost-effective.

Recurring payments: Consumers are using ACH for recurring bills—think mortgage payments, utilities, and subscriptions—because it offers a hassle-free, automated experience.

Same-day ACH expansion: The introduction of same-day ACH has added speed and flexibility, making it a viable option for time-sensitive transactions.

The Takeaway: ACH transfers are booming because they meet the needs of both businesses and consumers for low-cost, reliable, and increasingly faster payments.

⚡ What’s growing: the arrival of instant payments

The U.S. has been slower than some countries to adopt real-time payments, but that’s changing fast. The launch of the FedNow Service in July 2023 marked a turning point, enabling instant, round-the-clock payment processing.

Key drivers behind instant payments:

The demand for speed: In today’s digital economy, consumers and businesses expect immediate access to funds. Waiting days for a payment to clear is no longer acceptable.

Private sector innovation: The rise of platforms like Zelle and Venmo has pushed the industry towards real-time solutions. FedNow is the Federal Reserve’s response, ensuring a nationwide infrastructure for instant payments.

New use cases: Instant payments unlock opportunities for real-time bill payments, peer-to-peer transfers, and enhanced cash flow for businesses. Imagine paying a utility bill just before it’s due and having it settle instantly.

Looking ahead: Instant payments are not just a trend; they are the future of money movement in the U.S., opening doors for new financial products and services that cater to the demand for immediacy.